do pastors pay taxes on book sales

There are three main tax benefits for pastors. If a church withholds FICA taxes for a.

How Do And How Much Do Average Pastors Ministers Make Money Quora

The following required message applies to taxable transactions delivered into Alabama.

. While youre gathering and organizing your receipts or setting up your new-author organization system for the coming. This is because pastors always have to pay those taxes under the SECA program as opposed to FICA as if they were self-employed. Below is an explanation of the rules that govern gifts.

Their wages are very low. However there are some exceptions such as traveling evangelists who are independent contractors self-employed under. Setting a pastors compensation is a complicated issue says CPA Stan Reiff a partner with the accounting firm CapinCrouse.

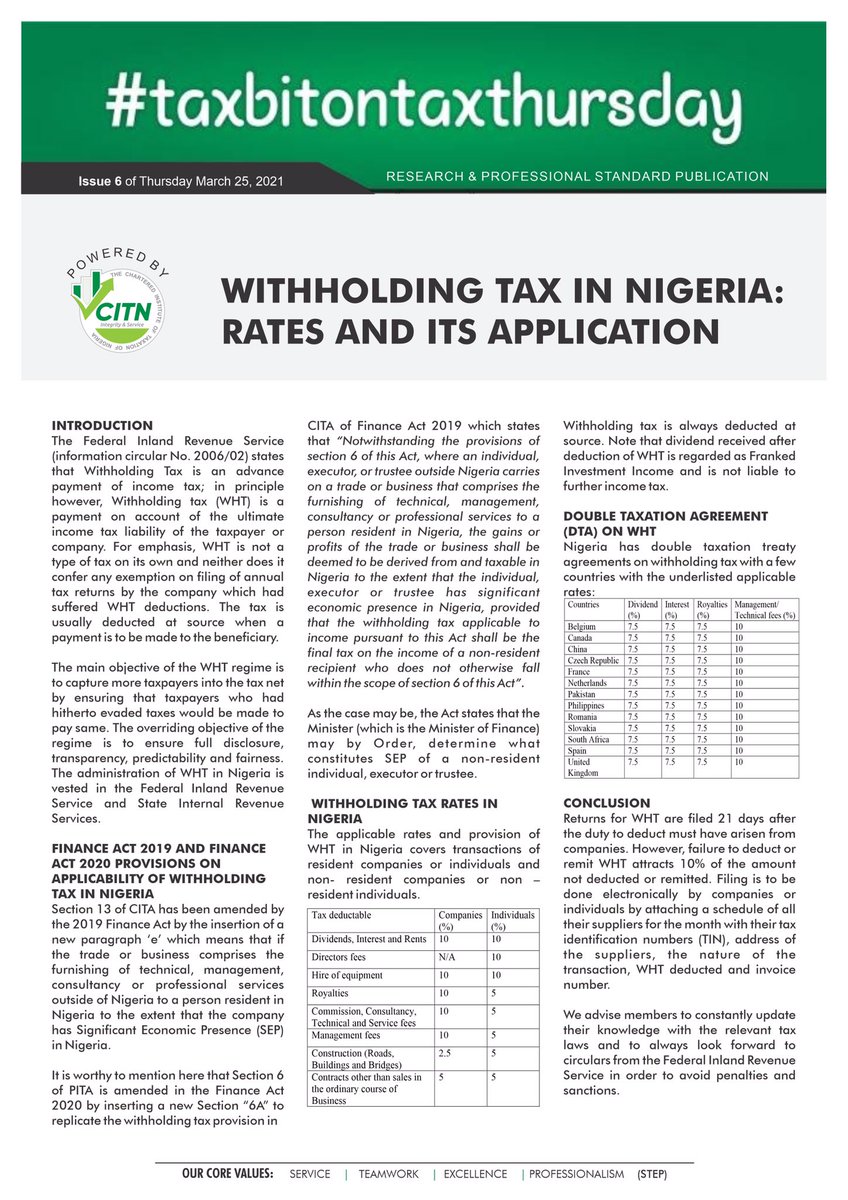

There are some exceptions to this tax including the sale of books that directly promote a churchs tenets. A number of factorsthe size of the church the local cost of living the experience level of the pastorplay a role. This is because pastors always have to pay those taxes under the SECA program as opposed to FICA as if they were self-employed.

They must pay SE taxes on their housingparsonage and utility allowance. That is still not a good reason to pay a pastor unfairly. Housing allowance is one of the greatest financial benefits available to pastors.

As a result the church should pay sales tax on prize purchases. For example if you sell your books for one day at the Brooklyn Book Festival and only make 250 you dont have to remit taxes. IRS rules that a religious organizations sales of books by its founder did not generate unrelated business income.

If the church buys the book outright no accountable reimbursement plan then you may have more to address. With the 2018 tax changes the standard deduction is up by between 150 and 300 depending on filing status. Topic 417 -- Earnings for Clergy New York Times.

You will need to track exempt sales versus UBI. Moral of the story. Second I am aware that many people are unemployed and that anyone who has a job should be grateful.

How Tax Professionals Can Avoid Criminal Trouble. Typical Tax Deductions for Authors. Reiff recently spoke with us about how a church can address the issue of pastoral compensation.

Most pastors are not overpaid. If your church bookstores UBI reaches 1000 annually before deducting expenses you are required to file a tax return to report the income and pay income tax on the net profit after expenses. In fact not only do they not have to withhold taxes but churches arent allowed to withhold Social Security and Medicare taxes also called FICA or payroll taxes.

Sellers program account number is SSU-R010162935. A licensed commissioned or ordained minister is generally the common law employee of the church denomination sect or organization that employs him or her to provide ministerial services. How Fraud Really Affects the Victims.

8-2015 Catalog Number 21096G Department of the Treasury Internal Revenue Service wwwirsgov. If you sell your book at a different New York fair thats four days long youre obligated to collect and remit sales taxes on the. The big difference is that with self-employment tax pastors have to pay both their share of the contribution and the employer share and they pay it out-of-pocket.

Rules on gifts given by your church. If your housing is worth 700 per month that must be clearly stated to prevent claiming more on the tax exclusion. 417 Earnings for Clergy.

The moment your church decides to give your pastor a gift of appreciation you must determine if the gift is taxable or if the gift falls under an exception. Federal law imposes a tax on the unrelated business income of churches and other taxexempt organizations. 2019 Church Clergy Tax Guide Richard R Hammar 9781614072416 Amazon Com Books 2022 Church Clergy Tax Guide Tax Mistakes Ministers Quarterly Tax Estimates Nonprofit Cpa 2022 Church Clergy Tax Guide Book.

They often have a Schedule C for the honoraria such as weddings and funerals they perform and a W-2 from the church the job of being a minster. Clergy Financial Resources. Another mistake regarding sales tax relates to the pastors parsonage.

Top Ten Tax Deductions. As a final note this brief article is relevant to all paid church staff though my focus is here on. Housing to Paychecks to Books.

Instead religious leaders pay their contributions through the Self-Employment Contribution Acts tax. If you are purchasing books for sermons and the church reimburses you for that purchase under an accountable reimbursement plan it should not be considered taxable. Self-Employment Tax Exemption and.

In many states the church may not use its sales-tax exemption to purchase items for the parsonage because the intended use is personal and not ministry related. Tax Exempt and Government Entities EXEMPT ORGANIZATIONS Tax Guide for Churches Religious Organizations 501c3 Publication 1828 Rev. If you make 1000 youre liable for taxes on the sales you make over 600 or 400.

He can request that the church withhold 800 of income tax from each months paycheck. Of course your church must allot a set fair amount for your housing costs. Seller has collected the simplified sellers use tax on taxable transactions delivered into Alabama and the tax will be remitted on the customers behalf to the Alabama Department of Revenue.

FICASECA Payroll Taxes. We have handled cases. This means congregation members may be less tempted to itemize which could reduce giving to churches.

Furthermore self-employment tax is 153 percent as of the 2013 tax year. Bookmarks launch parties Book Expo America BEA trade show attendance membership fees for the Authors Guild those are just a few of the business expenses a book author might incur. And most pastors manage their limited finances well.

All gifts of cash gift certificates or gift cards are always taxable. Social Security and Other Information for Members of the Clergy and Religious Workers Page 2. You cant be allotted 800 tax-free if your cost of living is only 700.

No one is above the tax law not even the clergy. The minister who is considered a church employee must complete a form W-4 and request that a specific amount be withheld from each paycheck. Understanding and using these three benefits will transform your taxes and be a blessing to you.

They pay no income taxes on their qualified housingparsonage and utility allowance. For example if a minister estimates that his combined income and self-employment tax for the year will be 9600. Know all the ins and outs of the rules or you could be led astray.

For pastors and clergy members themselves it may change the decision to itemize too. That means you wont be taxed on necessary work-related housing expenses. Therefore the gifts the pastor received in the blue envelopes counted as taxable compensation.

Looking To Improve Your Business Sales This Free 15 Day Online Business Challenge Can Help You Easy Business Ideas Online Business Launch Make Money Blogging

1 Smustla Chelseaharfoush Twitter

Religion Based Tax Breaks Housing To Paychecks To Books The New York Times

Chapter 9 The American Way Of The World 1804 In The Letters Of Johann Ernst Bergmann Ebenezer Georgia 1786 1824

States May Tax Bible Sales Christianity Today

Looking To Improve Your Business Sales This Free 15 Day Online Business Challenge Can Help You Easy Business Ideas Online Business Launch Make Money Blogging

Home Business Tax Deductions Are Just One Reason Of Many That A Home Based Business Is So Attrac Business Tax Deductions Small Business Tax Business Expense

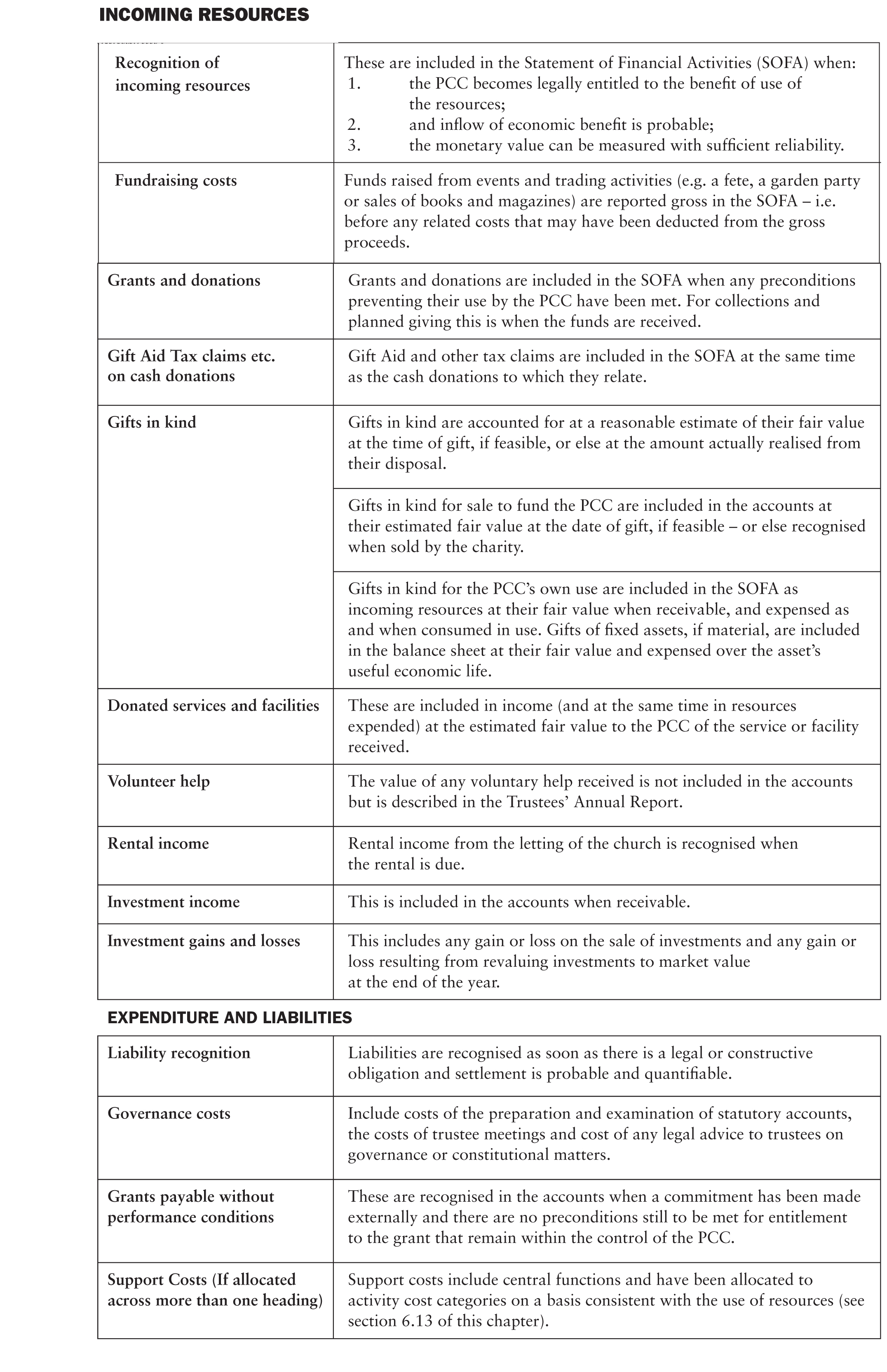

Chapter 6 The Church Of England

Chapter 7 The Church Of England

This Quick Reference Guide To Business Taxes Give You A Better Understanding Of Why You Are Paying Cer Bookkeeping Business Business Tax Small Business Planner

Resisting Disinfodemic Media And Information Literacy For Everyone By Everyone Selected Papers

Elevation Church Pastor Sells Books From Pulpit Wcnc Com

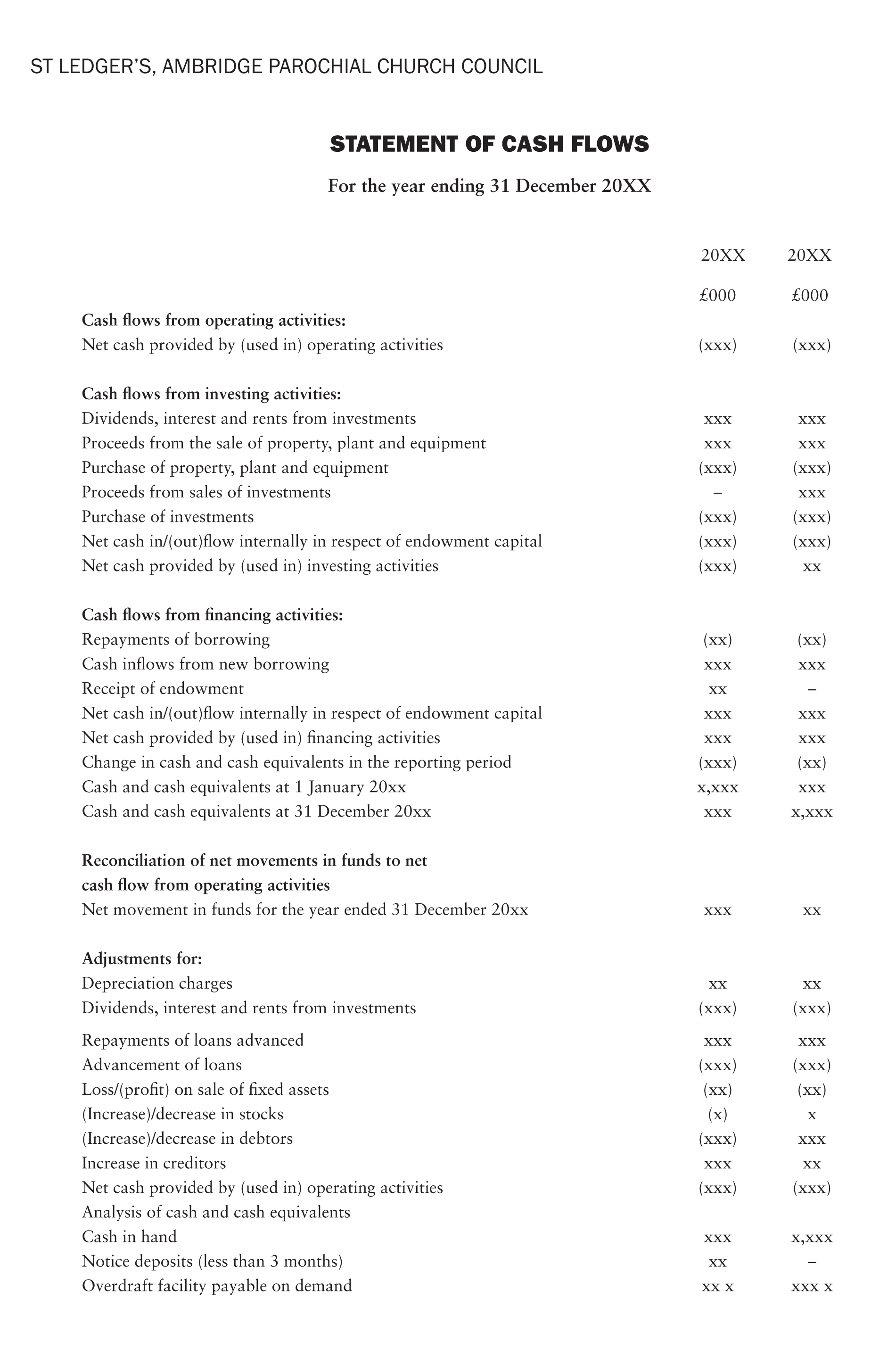

Financial Ratios Cash Flow Statement Accountingcoach Income Statement Cash Flow Statement Financial Ratio

Alan Ross Director Wilson Partners Limited Linkedin

Louis Namwanja Kizito Louisnkizito Twitter

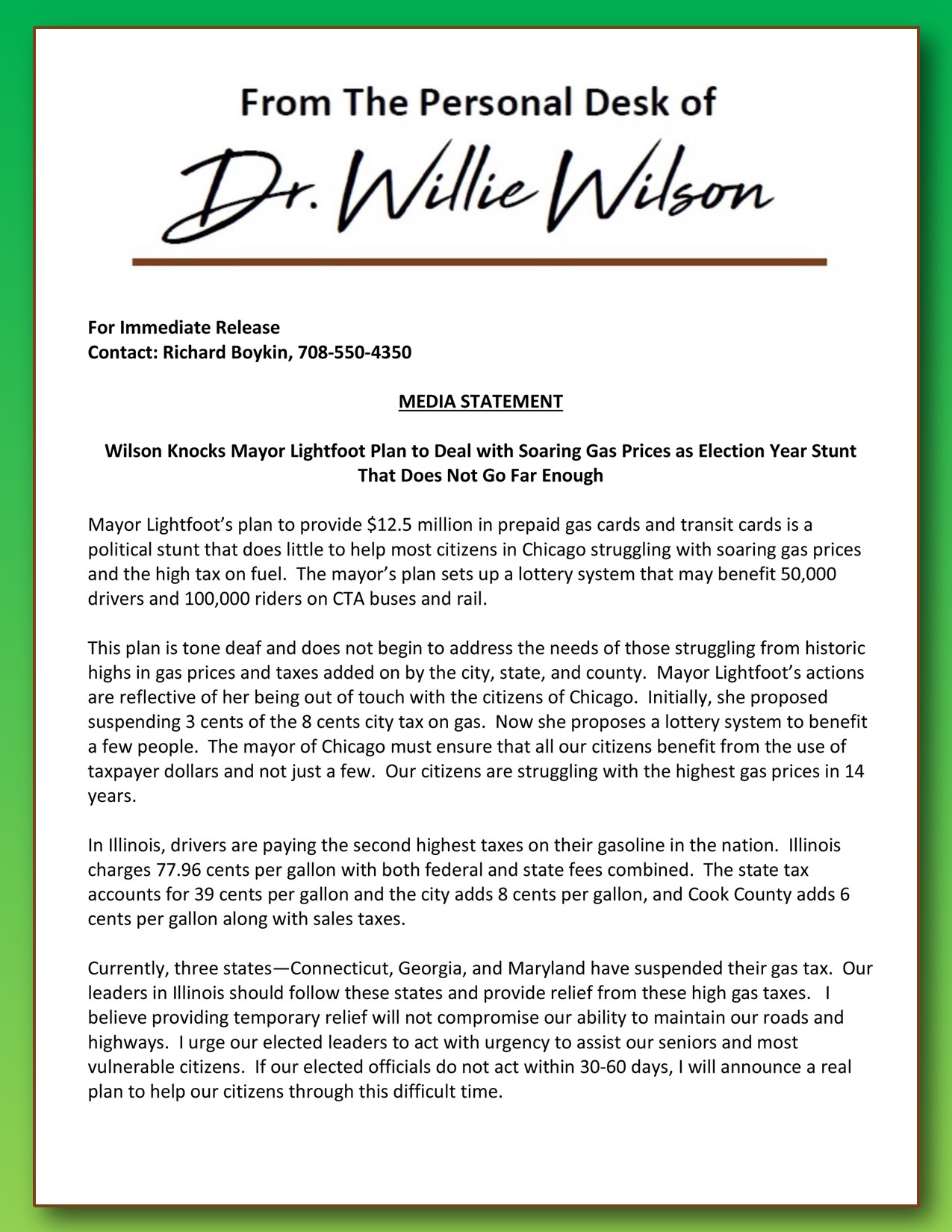

Tweets With Replies By Dr Willie Wilson Drwilliewilson Twitter

/thanksgiving.jpg)